Are you considering adoption but concerned about costs? Many hopeful parents hesitate to pursue adoption because they’re unsure if they can afford it.

Costs vary widely based on the type of adoption and your situation, but with the right support, it’s more achievable than most realize. Understanding how much adoption costs in Illinois is the first step in financial planning to build your family.

Get your personalized cost breakdown from an Illinois newborn adoption agency with 27 years of trusted support.

Illinois Adoption Cost Overview by Type

Adoption costs vary widely depending on the path you take. Some families spend around $35,000, while others invest over $60,000 by the time their adoption is finalized.

The total cost depends on the adoption type, how long the process takes, and what services are required. This section breaks down the average expenses, what influences pricing, and early parenting costs that add to the overall budget.

Cost Ranges by Type

When researching how much adoption costs in Illinois, the type of adoption you choose impacts your total investment. Each option comes with its own timeline, legal process, and professional fees.

Here’s a general overview of adoption costs in Illinois:

- Domestic infant adoption: $35,000 to $65,000

- Step-parent adoption: $1,500 to $4,000

- Relative adoption: $2,000 to $5,000

- Independent adoption vs. agency adoption: $5,000 to $15,000 variation

- Private vs. public agency: Private agencies often charge more but include full-service support and dedicated counselors.

These estimates don’t include additional out-of-pocket expenses that can vary from case to case (like travel or the cost of missed work, especially in international adoptions, which tend to be more expensive).

Why International Adoption Often Costs More

While international adoption can seem more affordable at first glance, families often face unexpected expenses. Travel, documentation, legal translations, and longer processing times all contribute to a higher final total.

Many countries have tightened restrictions or closed programs for U.S. families, which has led to delays and additional legal steps. Countries that do not allow United States citizens to adopt include Russia and Ethiopia (except in the cases of U.S. families of Ethiopian descent). Most recently, China has banned U.S. adoptions, leaving hundreds of families with pending adoptions not able to be completed.

Issues surrounding violations of the Hague Adoption Convention led to the United States not allowing adoptions to come in from Cambodia, Guatemala, Nepal, and Vietnam. The financial and emotional strain of stalled or pending adoptions can be significant.

What Drives Variation in Illinois Adoption Costs?

Several factors cause adoption costs to fluctuate. The timeline matters. A process that stretches from six to 24 months can include added legal fees, court filings, or new home study requirements.

Multiple adoption attempts also raise overall costs. In Illinois, DCFS regulations, legal compliance steps, and whether a family lives in a metro or rural area affect the cost of adoption.

Illinois adoption costs tend to sit slightly above the national average, and the Chicago area typically sees higher rates as it’s a higher cost-of-living city. Transparency is essential; unclear fee structures or vague service descriptions can be red flags.

Early Baby-Related Expenses Add Up

On top of agency fees, new parents should be ready for immediate baby-related costs. The cost of formula continues to rise, and diapers are more expensive than ever.

The average cost of daycare programs in Illinois is also a significant consideration for working parents. These are just a few of the Illinois adoption expenses families should plan for during the first year.

Domestic Infant Adoption Detailed Cost Breakdown

Domestic adoption includes several predictable and necessary costs. This adoption cost breakdown in Illinois can help families create a clear budget and avoid surprises.

- Agency program fees: $15,000 to $30,000

- Includes matching services, counseling, and adoptive parent support

- Includes matching services, counseling, and adoptive parent support

- Legal fees for adoptive parents: $10,000 to $12,000

- Attorney representation and documentation review

- Attorney representation and documentation review

- Birth mother living expenses: $3,000 to $8,000

- Rent, utilities, and groceries allowed under Illinois law

- Rent, utilities, and groceries allowed under Illinois law

- Medical expenses not covered by insurance: $2,000 to $10,000

- Home study fees: $2,000 to $4,000

- Includes background checks, home visits, and training.

- Birth mother counseling: $1,000 to $3,000

- Birth mothers have the right to request this under Illinois law.

- Post-placement supervision: $1,500 to $3,000

- Required visits before adoption finalization

- Travel and lodging expenses: $500 to $3,000

- Includes hospital stays and out-of-state placements

- Advertising and networking cost: $500 to $2,000

- Includes profiles, websites, and traveling to meet birth families

- Court and legal filing fees: $500 to $1,500

- Birth certificate and documentation: $200 to $500

- Emergency contingency fund: 15% of the total budget recommended

- Insurance coverage gaps may leave some costs unpaid out-of-pocket.

Financial Assistance and Cost Reduction Options

Families may worry that adoption is out of reach, but multiple financial assistance programs can significantly reduce how much adoption costs for Illinois families. A wide range of funding options is available to make adoption more affordable.

Exploring different types of Illinois adoption financial assistance can help you build a realistic budget.

- Federal adoption tax credit: The federal adoption tax credit allows families to claim up to $17,280 per child for the 2025 tax year and $16,950 per child for the 2024 tax year (for qualified adoption expenses). Most domestic adoptions are eligible, and the credit can be carried forward for up to five years.

- State adoption tax credit: Illinois also offers a state adoption tax deduction of up to $2,000 (for married couples), which can further reduce your taxable income. If you are married and filing separately, you can claim $1,000 in qualified adoption expenses.

- Employer adoption benefits: Many Illinois employers offer several hundred dollars to several thousand dollars in benefits. Talk to your HR department for more details.

- Adoption grants: $500 to $10,000 from organizations like Gift of Adoption

- Faith-based adoption funds: Available through churches and religious groups

- Military adoption benefits: $2,000 to $5,000 for eligible service members

- Crowdfunding platforms: AdoptTogether, Pathways for Little Feet, GoFundMe

- Low-interest adoption loans: Typically 6–12% APR

- Health Savings Account (HSA) and Flexible Spending Account (FSA): May apply to qualifying adoption-related costs (like bloodwork or therapy services for prospective parents).

- An Adoption Advantage Account, a type of FSA: Lets you pay for adoption expenses with tax-free dollars.

- Life insurance or 401(k) withdrawals: Use with caution.

- Union or professional assistance programs

Plan ahead: It’s wise to apply for grants six to 12 months before beginning your adoption journey and combine multiple funding sources for maximum results.

Use this guide as your go-to adoption costs breakdown for Illinois:

Hidden Costs and Budget Planning Strategies

Unexpected costs can quickly catch families off guard during the adoption process. Some expenses, such as legal complications or extra birth mother support, may not be covered by your original estimate.

Others, like a failed adoption attempt, can result in a loss of $5,000 to $15,000. Planning ahead for these Illinois adoption expenses is an important part of budgeting.

When asking about how much adoption costs in Illinois, remember these factors:

- Travel and medical emergencies: Emergency travel for early labor, extended hospital stays, and NICU care can quickly lead to major out-of-pocket costs, especially if you’re far from the hospital or your insurance has a high deductible.

- Communication and remote coordination: Phone calls, data plans, secure messaging apps, and video software may be needed to stay in touch with the birth mother throughout the process.

- Work and childcare disruptions: Unpaid time off, temporary loss of income, and childcare costs for other children (if applicable) should be part of your early budget planning. Make sure to calculate this cost for both adoptive parents. Many expectant moms are going to want (and expect) both parents to be at the birth.

- Time-sensitive legal or documentation issues: If a situation requires expedited court documents or urgent legal help, costs can rise fast. Always plan for last-minute professional support.

- Household and safety updates: Home modifications like outlet covers, baby gates, or accessibility changes can add up. Baby supplies and nursery setup typically cost $2,000 to $5,000.

- Profile, networking, and celebration expenses: Family profile photography ($500 to $1,500), networking event travel, and post-adoption celebrations are joyful parts of the process, but they can increase your overall budget.

Based on our extensive experience, we recommend the following smart strategies:

- Set aside an emergency fund equal to 20% of your total adoption budget.

- Track monthly expenses to ensure you stay within your budget.

- Plan for your child’s future needs, including education and healthcare.

Illinois Legal Requirements and Associated Costs

Illinois state regulations affect every stage of the adoption process, from home studies to finalization. These rules directly influence how much adoption costs in Illinois compared to other states.

Families must comply with the Illinois Adoption Act, which includes legal, procedural, and compliance-related steps that can increase the overall expense.

Key costs include the mandatory six-month post-placement supervision period. Beyond that, you’ll need DCFS licensing and background checks and the required FBI, state, and local (county or city) background screenings.

Additional compliance-related expenses may involve:

- Illinois-specific home study requirements and associated training fees

- Interstate Compact on Placement of Children (ICPC) fees for out-of-state adoptions

- Court filing fees, which vary by county ($200 to $500)

- Birth certificate amendments and processing fees

- Medical exams for adoptive parents

- Six hours of mandatory training for private adoption cases

- Legal advertising costs in approved publications

- Record keeping and documentation storage

- Legal representation at the adoption finalization hearing

- Appeals process costs if legal issues arise

- Professional licensing verification costs for adoption agencies

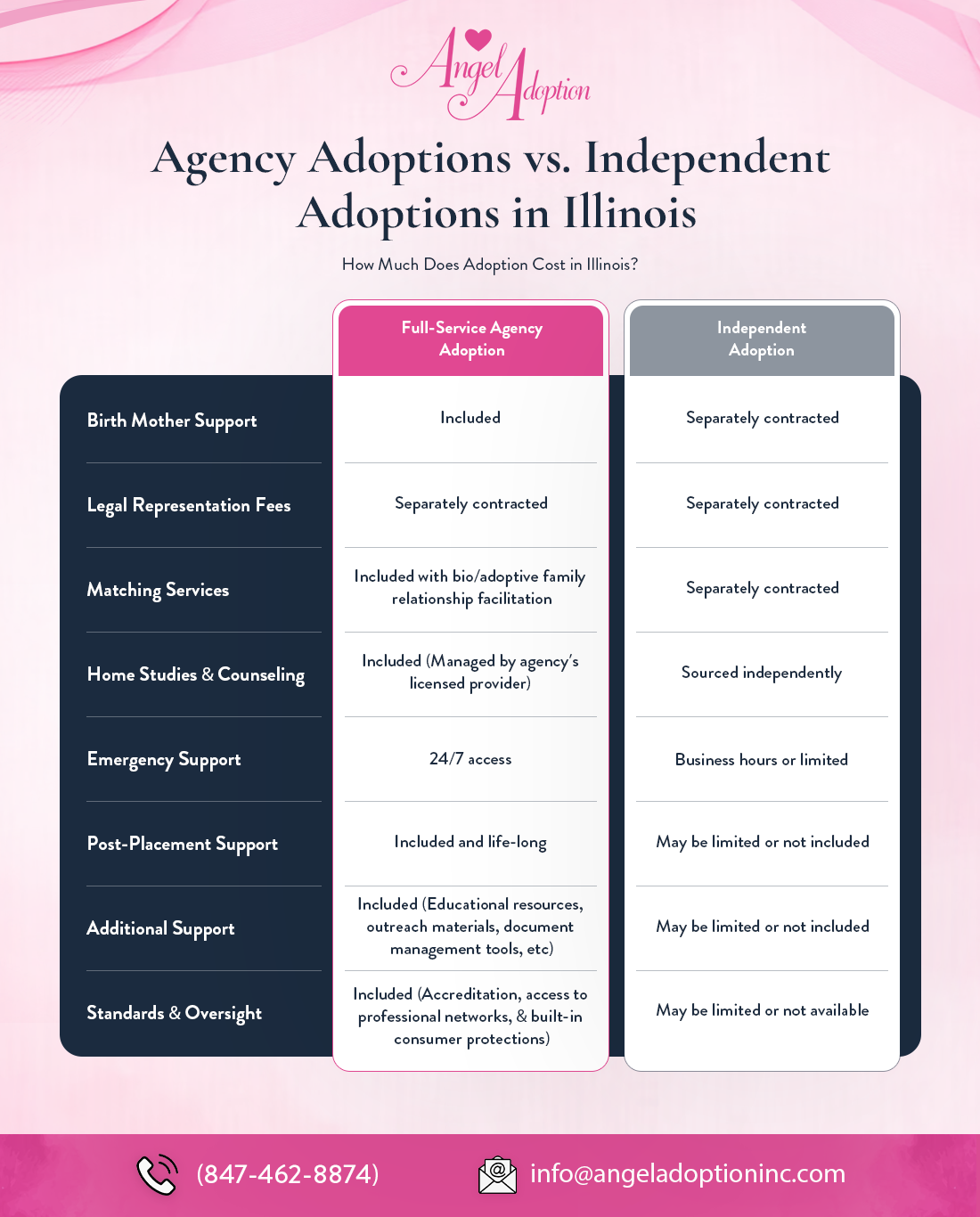

Agency vs. Independent Adoption Cost Analysis

While agencies may seem more expensive up front, they often include services that would otherwise require separate fees. For families relying on Illinois adoption financial assistance or seeking comprehensive support, a full-service agency can streamline the process and reduce long-term stress.

Take a look at our Illinois adoption costs comparison chart to see how the two types of adoptions differ.

While a full-service agency adoption may appear more costly upfront, do a cost-benefit analysis: consider potential risks, long-term support, the established relationship value for future adoptions, and success rates. Weigh this against upfront savings with independent adoption to make the best decision for your family.

Success Stories and Cost Management Examples

Many hopeful parents wonder whether they can realistically afford to adopt. With the right preparation, it’s absolutely possible. Real Illinois families demonstrate that managing how adoption costs in Illinois is achievable with proper planning. From employer assistance to community-driven fundraising, smart strategies can make a life-changing difference.

Here are a few examples:

- Family #1 completed a domestic adoption for $45,000, securing $20,000 in Illinois adoption financial assistance through a combination of employer benefits and adoption grants.

- Family #2 raised $35,000 through community fundraisers and social media-based crowdfunding, which covered nearly all of their Illinois adoption expenses.

Other families succeeded by:

- Combining multiple grants

- Using emergency funds to avoid delays

- Finding unexpected resources through network referrals

- Reducing costs by managing timelines and avoiding rush fees

- Negotiating with insurance to cover unexpected medical fees

- Securing employer funding beyond standard offerings

- Timing tax credit applications strategically to maximize the benefit

- Prioritizing à la carte pricing so they only pay for what they need

Beyond budgeting, the emotional impact of adoption is reflected in the experiences of families brought together by Angel Adoption.

Andrew and MaryKate received financial gifts from their church that helped ease the cost of adoption. Their story highlights how community support can make adoption more affordable and meaningful.

Rachel and Bradley shared how the connection with their child’s birth mother and the support from Angel Adoption made their experience deeply personal and rewarding — a reminder that love is the real foundation of every adoption. Their story highlights the way support is emotional and financial, with their family and friends providing encouragement and essentials through a baby shower.

Wrapping Up: How Much Does Adoption Cost in Illinois?

While adoption costs in Illinois can vary (depending on adoption type and specific circumstances), proper planning and financial assistance make adoption achievable for many families.

Cost should never stand in the way of your dream to adopt. Your family deserves transparent cost information and expert guidance. Angel Adoption has helped hundreds of families successfully navigate adoption expenses over the past 27 years. If you have more questions about how much adoption costs in Illinois, we are here to help.

Schedule your cost consultation today, and discover why Illinois families trust us for honest pricing and comprehensive support.